Speculation Mounts Around Possible Clover Health – Humana AI Partnership

July 5, 2025 — New York — Talk of a potential partnership between Clover Health’s AI division, Counterpart Health, and insurance giant Humana has gained traction after a string of digital breadcrumbs and recent corporate remarks ignited speculation throughout the healthcare and investment communities. While neither company has made a formal announcement, the circumstantial evidence has grown too aligned to ignore, hinting that Humana may be preparing to deploy Clover’s AI platform across its vast Medicare Advantage operations. If true, the move could be a game-changer for both companies: a potential multi-billion-dollar opportunity for recently struggling Humana, and a defining moment in Clover Health’s reinvention from insurance underdog to healthcare tech disruptor.

The speculation began after Humana’s June 16 investor meeting, during which executives outlined the company’s path forward amid growing challenges. Humana has recently been under significant pressure due to declining Medicare Advantage Star Ratings, rising medical costs, and an increasingly complex regulatory environment. To address these headwinds, the company presented a long-term strategy focused on operational efficiency, automation, and simplification. Humana stated it would “leverage outsourcing and technology to simplify and automate processes… while driving efficiencies”. What made the presentation even more notable was the timeline Humana laid out. The company projected a gradual improvement in cost efficiency – starting with baseline progress in 2026, and a full impact by 2028. That timeline is nearly identical to the three-year cost savings arc marketed by Counterpart Health, which claims its AI can reduce a payer’s Medical Cost Ratio by 7% in year two and up to 15% by year three. While Humana did not mention specific partners, the language prompted the beginning of the speculation.

The rumor mill kicked into high gear this week when a publicly available subdomain scan of Counterpart Health’s website revealed a curious pattern. Alongside previously announced partners like Duke Connected Care, The Iowa Clinic, and Southern Illinois Healthcare, a number of new subdomains appeared bearing the Humana name. These backend URLs indicate that technical infrastructure might be under development to support a potential relationship between Counterpart and Humana. Notably, the same pattern of subdomains was observed prior to official announcements for Duke, Iowa Clinic, and Southern Illinois Healthcare, all of which later confirmed deals with Counterpart Health. While these web addresses alone don’t confirm a deal, their presence strongly suggests that backend systems and integrations are potentially being developed in anticipation of one.

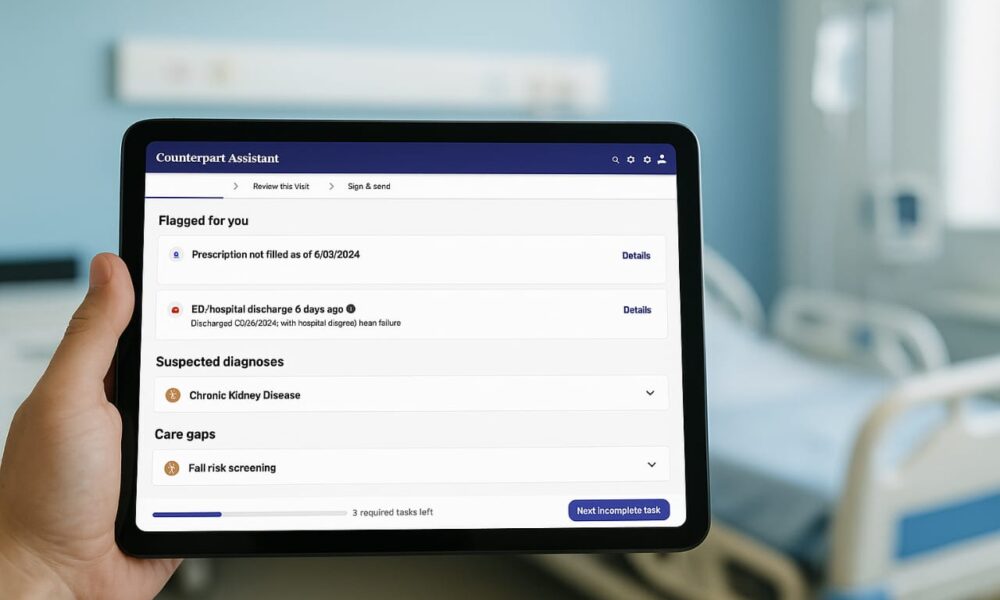

Clover Health has touted its Counterpart Assistant platform as a game-changing clinical AI tool that can reduce a payer’s Medical Cost Ratio by up to 15%. For context, Clover Health itself posted an MCR of 75.1% in 2024, one of the most efficient in the industry. Meanwhile, Humana has struggled with an increasing MCR due to a variety of headwinds. If Humana were to achieve even a fraction of the cost savings that Clover Health claims are possible, the financial impact could be enormous for the company – potentially saving billions annually.

For Clover Health, such a partnership would represent a dramatic turning point. The company, which went public via SPAC in 2021, has spent years battling poor investor sentiment, regulatory scrutiny, and heavy skepticism over its long-term viability. Once seen as just another Medicare Advantage insurer, Clover has been actively repositioning itself around its AI platform, Counterpart Assistant – a tool designed to centralize patient data, assist physicians with real-time clinical insights, and reduce avoidable medical costs. The company attributes its own low MCR of 75.1% to this technology and has begun licensing it to external payers and provider groups under its Counterpart Health brand.

A deal with Humana – one of the largest Medicare Advantage organizations in the country – would give Clover Health a level of validation it has never experienced. It would instantly elevate the perception of the company from a traditional insurer to a high-margin, health-AI disrupting SaaS. Investors would no longer value Clover based on insurance metrics, but rather on recurring software revenue, gross margins, and enterprise tech multiples.

Although neither Humana nor Clover has commented publicly, and no regulatory filings have confirmed a formal agreement, the emerging pattern is increasingly difficult to ignore: a shared strategic direction, an almost identical cost-cutting timeline, and Humana’s digital infrastructure woven into Counterpart Health’s operations. If the partnership is ultimately validated, it could mark a major milestone for AI in healthcare – and potentially the long-awaited inflection point in the turnaround journeys of both Clover Health and Humana.